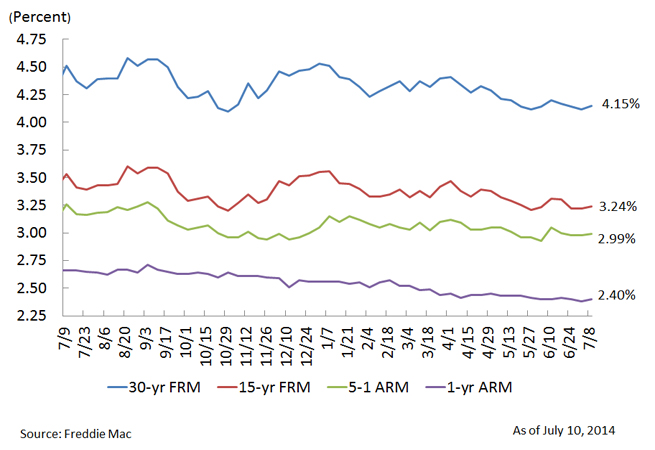

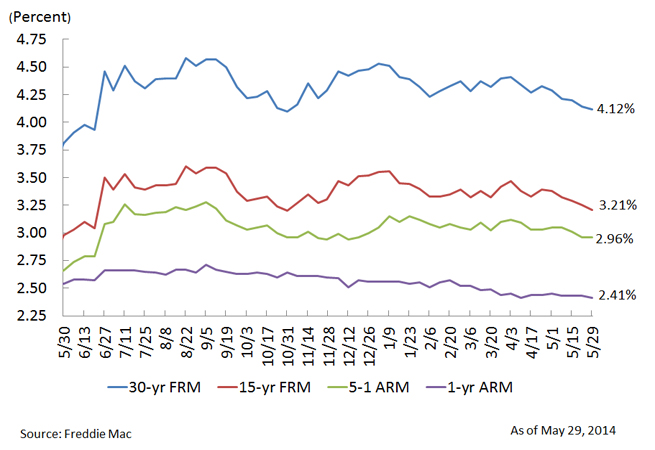

Mortgage rates hovered near their lowest levels, according to information released this week. The Federal Home Loan Mortgage Corporation (Freddie Mac) announced that average rates for a 30-year fixed loan are 4.15%, up slightly from 4.12% the previous week.

Freddie Mac calculates the average mortgage rate by surveying lenders across the United States Monday through Wednesday, then releasing the results of the Primary Mortgage Market Survey each Thursday morning. The recent rates are good news for homebuyers, who are now enjoying lower rates than last year at this time, when average 30-year fixed loan rates reached 4.51%. The 15-year-fixed rate average is also lower than a year ago at 3.24% compared to 3.53%.

While the rates did increase a bit this week, it’s not too surprising, according to economists. The latest employment report released by the U.S. Bureau of Labor Statistics last week created some upward pressure on mortgage rates this week. Last month 288,000 jobs were added, and the unemployment rate dropped to 6.1%. It was the fifth month in a row that more than 200,000 jobs were added, and the gains were across multiple sectors, led by employment growth in professional and business services.

For those looking to buy, rates may not get much lower. At the June Federal Open Market Committee (FOMC) meeting, officials with the Federal Reserve agreed that the economy appears to be recovering from the severe dip this winter. The Fed is therefore planning to further reduce its bond purchases. Ben Bernanke began tapering the purchases in December 2013, and the quantitative easing program is expected to end later this year, possibly as soon as October. The Fed will, however, continue to keep the federal funds rate at its current near-zero level for some time, which keeps interest rates low.

Recent Comments