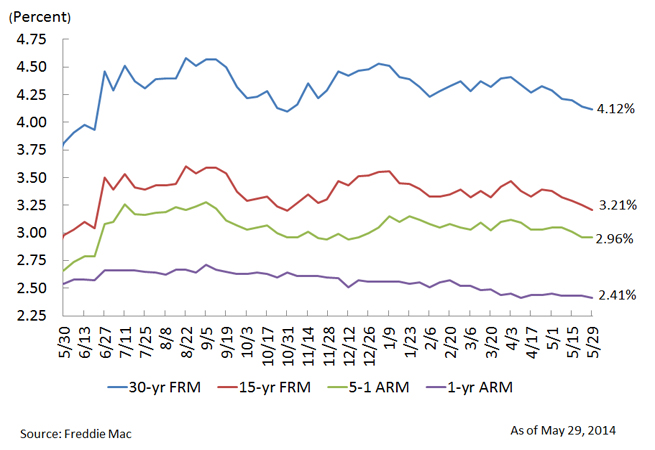

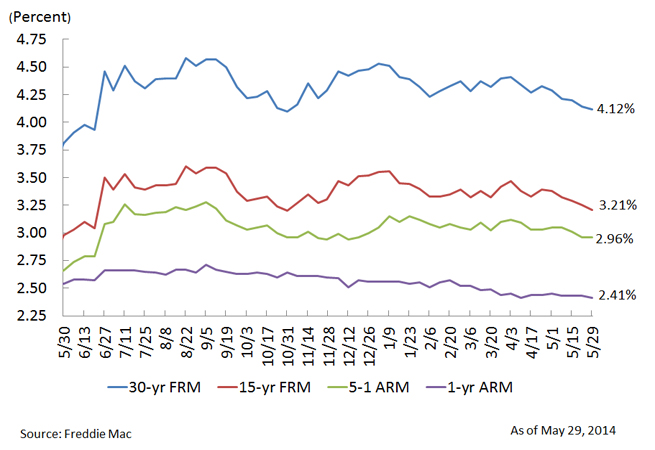

The weather is warming up across the country as spring gives way to summer and the normally busy home-buying season begins. This year the home sales have been slow, but the weekly Primary Mortgage Market Survey by Freddie Mac may be bringing good news for buyers looking for a deal and sellers hoping to move homes.

For the fifth week in a row, mortgage rates for 30-year fixed-rate loans dropped, reaching an average of 4.12% on May 29. That’s the lowest level so far in 2014, although still up from the 3.81% average at this time last year. Offerings for 15-year fixed-rate mortgages have followed much the same pattern, averaging 3.21%, down from 3.25% the previous week but up from 2.98% at this time last year.

U.S. Weekly Average Mortgage Rates

Home sales have been slow in 2014, and analysts place some of the blame on the extreme winter weather experienced across the country. Snow buried portions of the north, but unexpected snow storms slammed the southeast as well, damaging the overall sales outlook.

Home sales have been slow in 2014, and analysts place some of the blame on the extreme winter weather experienced across the country. Snow buried portions of the north, but unexpected snow storms slammed the southeast as well, damaging the overall sales outlook.

However, as the economy continues to grow and the job market improves, analysts expect housing sales to climb. Construction of new homes jumped in April to the highest levels this year. Unfortunately, much of that came from apartments, which is not a positive sign for single-family home sales. Higher prices and a limited supply also affected sales.

Sales are still below 2013 levels, but pending sales increased in the Midwest and Northeast, despite drops in the South and West. Buyers have more choices with the increase in inventory, and the drop in the mortgage rates could give them more confidence heading into the peak buying season. On the home improvement side, both Home Depot and Lowe’s have reported recent strong sales, signaling owners could be doing renovations to prepare their homes for sale.

Keep track of the latest industry news by following us on Twitter and Facebook.

Recent Comments