The global battle for assets, placemaking, and demographic shifts are expected to be the big trends we see in 2014, and all three were front and center at the 25th annual MIPIM conference at the Palais des Festivals in Cannes, France. The four-day event held in March was attended by 21,000 participants from 93 countries and all real estate sectors. The conference featured many interesting talks, and I came away with some great facts about the state of real estate across the globe.

Here’s a look at the three big trends and how they are affecting markets around the world:

Assets – Asset overpricing in some regions will force investors to move to other sectors to stay successful. According to one panel, the top European sector right now is student housing while the top U.S. sector is industrial/warehouse. This is interesting given the large amount of capital being put into student housing in the United States (e.g., UT-Austin and Florida State University). PriceWaterhouseCoopers also expects to see more capital moving into specialty asset classes.

Placemaking – Think of this as sustainability. Sustainable assets are attractive to investors because they are inviting to tenants and have reduced obsolescence. Plus, sustainable assets tend to have a rent premium associated with them. One example from the real estate literature (Reichardt et al., Journal of Real Estate Research, 2012) shows a rent premium for Energy Star rated buildings as high as 7% (2008 Q2).

Demographics – This year will be a key one in regards to how the global population is changing. Europe is seeing a fairly stable population, while the United States (and most of North America) and Asia are seeing increases. The effects of these changes will play out over the next few years. This is certainly a hot topic—even the Urban Land Institute’s recent issue focused on demographic trends in Canadian cities.

The panel of experts from the United States and Europe discussed the changing face of real estate, including how New York City is going through the same changes London did just two years earlier. Analysts predict Spain will be the next big investment destination in Europe, while in Switzerland the Swedish franc is holding back investments in the country. We can also expect to see more long-term investors starting to look for opportunities in Africa. I have posted before about land tenure and valuation in Africa.

Five Big Ideas

Here are five important takeaways from the panel:

- Foreign direct investment (FDI) in France was down 77% in 2013.

- Energy costs in the United States are 50% to 66% cheaper than in Europe.

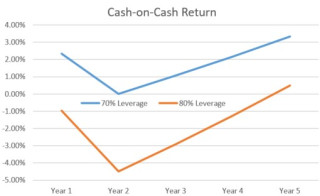

- The current economic recovery should be viewed in the context of typical real estate cycles.

- Full convertibility of the Renminbi (the official currency of the People’s Republic of China) will have a strong impact on economies broadly.

- Don’t lose sight of investing in people. It’s one of the most important investments that can be made.

I’ll be writing up more of my experiences from MIPIM, so stay tuned to the blog for more updates.

Dr. Cliff Lipscomb at the Palais des Festivals overlooking the harbor in Cannes, France, courtesy of Yuko Tomizuka.

– Clifford Lipscomb

Recent Comments