In the previous post in this series, we examined the increasing U.S. demand for large warehouse space. In this post, we will examine some of the factors determining where this demand is occurring now, and where it may shift to in the future.

We previously mentioned that transportation challenges such as driver shortages, stricter regulations, and volatile fuel costs, coupled with changing consumer demands, have necessitated improved performance standards for supply chains. Companies in sectors with high customer service demands are increasing their number of regional distribution centers and cross-dock facilities to reduce the distances to customer destinations. According to research by Cushman & Wakefield, the type of cutting-edge distribution centers now in demand often cost up to three times as much to build and require three times as many employees to operate as a traditional warehouse. They must be located near an affordable labor force and have access to rail, highways, and air transportation. Online sellers tend to select large population centers near FedEx or UPS hubs with an abundant seasonal workforce.1

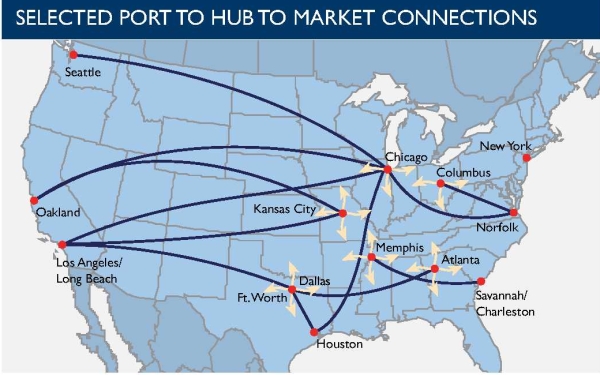

Map by Cushman & Wakefield.

The pressure for greater transportation efficiency has spurred the development of intermodal facilities, and inland ports are becoming critical to supply chain dynamics. The major inland hubs of Chicago, Columbus, Dallas/Fort Worth, and Atlanta have benefitted the most from increased international container volume from Asia. New locations are also under development, such as the 4,000-acre Florida Inland Port in St. Lucie, which is being engineered specifically in preparation for the Panama Canal expansion scheduled for completion in 2015. Also in anticipation of the expanded Panama Canal, four East Coast ports are deepening their harbors to handle post-Panamax ships: Baltimore, Miami, New York, and Norfolk.

Post-Panamax ships in San Francisco Bay, courtesy of NOAA.

Since two-thirds of the U.S. population resides east of the Mississippi River, after the Panama Canal expansion is completed in 2015, some of the products traditionally transported to the West Coast may instead be shipped to eastern ports. However, there’s still considerable debate about how much the Panama Canal expansion might actually benefit the East Coast and Gulf Coast ports. Traffic at many of these ports is likely to increase for other reasons though. Some will be bolstered by new manufacturing operations, such as Airbus (Mobile, AL), Boeing (Charleston, SC), and Caterpillar (Athens, GA).1 In addition, a 2012 commitment from Walt Disney Parks and Resorts to use the port of Jacksonville for most imports bound to its Central Florida parks may be a harbinger of other changes on the horizon.

With wages in China rising, manufacturing is shifting to Southeast Asia and the Indian subcontinent, which is driving more business to U.S. East Coast ports. Growing demand for industrial real estate in southeastern U.S. and Gulf Coast port locations has been further propelled by land that is relatively more affordable and abundant in cities like Savannah or Charleston compared to that in Los Angeles and Long Beach.1

It should be interesting to watch how these changes affect the availability and pricing of warehouse space in these markets.

Recent Comments